public bank housing loan interest rate 2016

The 5 Home Plan gives borrowers the flexibility of choosing fixed or floating rate pricing. Bank of India on the other hand has also increased its home loan interest rates from 65 to 69Indias largest mortgage lender HDFC has increased its prime lending rate by 30 basis points.

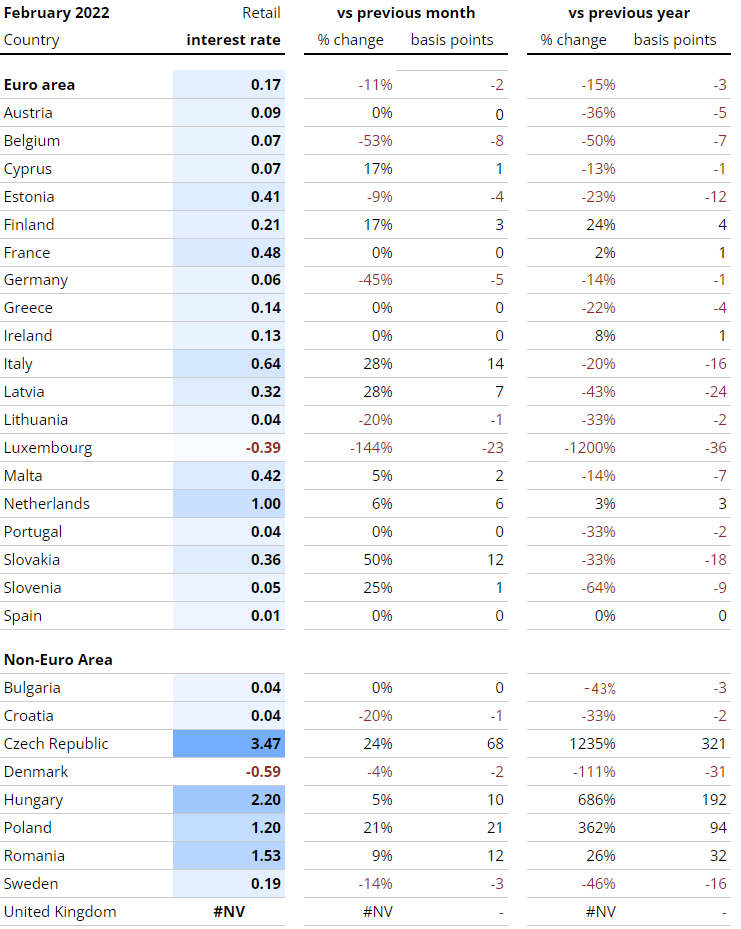

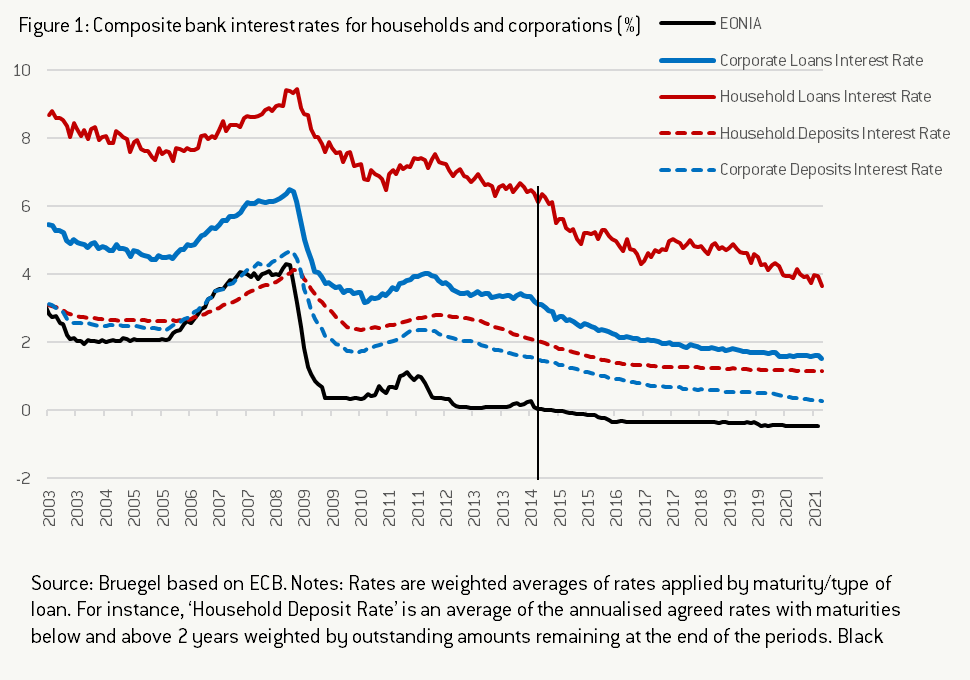

How Have The European Central Bank S Negative Rates Been Passed On Bruegel

The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20.

. The Federal National Mortgage Association has discontinued its free market auction system for commitments to purchase conventional home mortgages. This is the Indicator Lending Rates - Bank variable housing loans interest rate published by the Reserve Bank of Australia on 4 June 2019. Home loan interest rates for all lenders as of 07th July 2022.

By Aaron Terrazas on Dec. The public sector bank Bank of Baroda BOB hav increased its interest rate on home loan from 65 to 69. 3 Federal Housing Finance Boards Monthly Interest Rate Survey National Average Contract MortgageRate the Contract Rate on the composite of all.

Pre 30-year fixed-rate mortgage averaged 379 National monthly average rates are derived from HSHs database of 2000 to 3000 lenders. However the majority of experts in the Finder survey agree the. Mortgage Rates in 2016.

For example the Maybank Islamic HouzKEY offers a low home loan profit rate of 288 pa while another bank may offer 290 pa. So the consequence of the Fed raising interest rates is that the cost of funds will rise as Singapore banks will have to pay more to their lenders as well as higher rates when borrowing from each other. 11 hours agoThe one-year MCLR is the standard by which banks benchmark their home loan rates and for this duration the bank increased the rate.

Contents Online broker offering Interest rate. The Public Bank housing loan products offered by Public Bank include the 5 Home Plan which gives you the option to choose from a fixed Flexi and graduate loan repayment and the MORE Plan which is optimised for property refinancing. Following the Federal Reserve Boards December 2015 rate hike the first in a decade financial markets expected mortgage rates to steadily inch higher with a series of three to four more Fed.

Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. In addition international capital moved out of the US in search of higher yield when the Fed cut interest rates to 025 in 2009. The association clarified By Melissa Lee March 22nd 2017 Home Loan Tips Housing Loan Latest ArticleNews.

Home public bank housing loan interest rate 2016. Standard Chartered Bank 377. In a press release 17th March 2017 The Association of Banks in Malaysia ABM said the approval rate for housing loans in 2016 is high at 738.

Analysts at RateCity and Mortgage Choice also predicted rates to remain on hold. The interest rates given in the table are subject to the credit risk profile as. Therefore the Commissioner of Financial Institutions hereby announces that the maximum effective rate of interest per annum for home loans as set by the General Assembly in 1987 Public Chapter.

This will affect all floating rate home loans. But even with that a few commercial banks decided to increase their interest rates. At the start of 2016 expectations were high for mortgage rates.

SUMMARY AND MORTGAGE INTEREST RATE FORECAST FOR 2016 2017 AND 2018. National average rates on conventional conforming 30- and 15-year fixed and 1-Year CMT-indexed adjustable rate. Youve got questions Weve got answers.

749 1099. Public bank housing loan interest rate 2016. The number of board member within the Federal Open Market Committee FOMC forecasted median fed funds overnight target rates of 2016 at approximately 15 and 2017 at approximately 275 and 2018 at around 35 and a longer run interest rate at 325 to 35.

1 Freddie Mac 2 HSH Associates 3 Federal Housing Finance Board. Contact Us At 6012-6946746. Public Bank Malaysia has raised its base lending rate BLR from 685 to 695 base rate from 365 to 375 with effect from 17th May 2016.

1 Federal Home Loan Mortgage Corporations Freddie Mac Weekly Primary Mortgage Market Survey PMMS Monthly Average Values. LATEST BASE RATE AND BASE LENDING RATE FOR THE MAJOR BANKS IN. Annual Taxation Determinations for the benchmark interest rate are no longer published.

Hong Leong Bank 394. Usually home loan interest or profit rates between banks will not be too far away from each other. Housing loan interest rates in the table are subject to change anytime without prior notice.

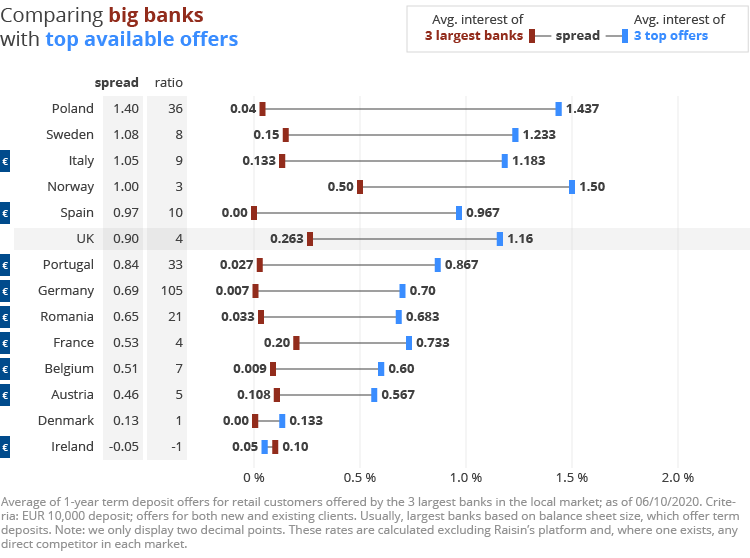

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Current Mortgage Interest Rates July 2022

Canara Net Banking Lettering Karnataka

What Are Interest Rates How Does Interest Work Credit Org

Rocketing Real Estate Prices In China Real Estate Prices Chinese House House Prices

If Buying A New House Has Been On Your Mind No Better Time Than This Festive Season Enjoy A Discount Of 9 4 On Select P Buying A New Home The Selection Tata

Ultra Low Interest Rates Symptom And Opportunity Cairn International Edition

Barron S On Twitter Investing How To Plan Term

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

Germany Long Term Interest Rate 1993 2022 Ceic Data

Thailand Interest Rate Thailand Economy Forecast Outlook

History Of Interest Rates In Australia Infochoice

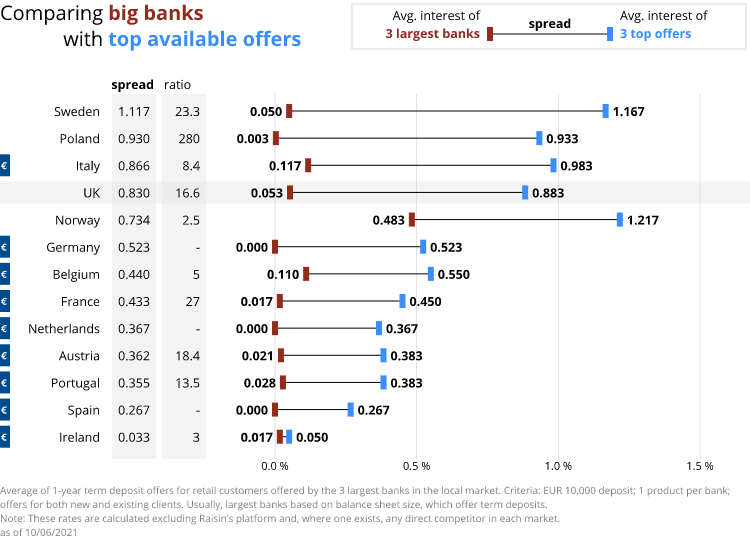

Interest Rates Explained By Raisin

Floating Rate Loans And The Impact Of Monetary Policy Vox Cepr Policy Portal

Interest Rates Explained By Raisin

Romania Interest Rate Romania Economy Forecast Outlook